Since 2007, the Steamboat Springs real estate market has been a wild and crazy ride. It started with the highest of highs, experienced the lowest of lows. It ruined the fortunes of some, yet created wealth for others. At least for now the market is on a track of recovery, but it is, after all, never-ending. Here’s a peek at that unpredictable, unprecedented and unruly roller coaster ride that even the best amusement park designer could not dream of engineering.

2007 Real Estate Market Statistics – A Record Year

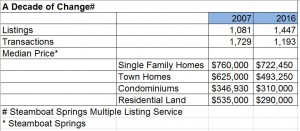

2007 was the most active market on record, with the Steamboat Springs Multiple Listing Service posting a record 1,729 transactions and surpassing $1 billion in volume for the first time. The annual absorption rate (transactions divided by listings) was a record 160 percent. Although not a part of the MLS records, helping fuel this frenzy was the sale of the Steamboat Ski Area to Intrawest for $256 million, Cafritz Investments purchasing two Ski Time Square parcels for $53.9 million for base area redevelopment, Starwood Hotels purchasing the Sheraton Hotel and golf course for $57 million, and at $24.6 million, a Las Vegas, NV developer purchasing 540 acres just west of the Steamboat Springs city limits. Known as “Steamboat 700,” this master planned community would ultimately bring about 2,000 homes, 380,000 square feet of commercial space, and 4,700 residents to town.

With only 1,081 listings on the market, buyers were competing with other buyers in multiple-offer bidding wars. Dating as far back as 1996, only 2006 was lower in listings (1,065). Loans were easy to come by. At 6 percent interest, 30 year fixed rate loans were some of the lowest rates banks had ever offered. Stated income/asset and “no doc” loans, with little auditing of files made it easy to access money. The median price of a single family home in Steamboat Springs was $850,000, a town home went for $629,500,and a condominium cost $349,700.

Due to the 33 percent increase in condo demand between 2004 and 2006, numerous projects were coming out of the ground or just being completed. In the ski village, construction was under way at One Steamboat Place (80 units), Edgemont (39), Trailhead Lodge (86), Emerald Lodge (32) and Bear Lodge (36). The downtown area was also a beehive of activity with Alpen Glow Condominiums (14), Howelsen Place (42), The Victoria (7) and The Olympian (23); all of which added 359 new condos to meet market demand that was envisioned to continue. Developers and lenders were feeling confident with buyers executing contracts for properties that would not be completed for a year or more.

Sixty-six land parcels sold within the Steamboat Springs city limits at a median price of $556,000. Sixty-two lots in Steamboat Barn Village were released between $445,500 and $1.125m and just into 2008 the 63-lot Alpine Mountain Ranch with five-acre sites between $1m and $2.5m. Located 17 miles south of town, Stagecoach was also very active, with 141 purchases and a median price of $67,500.

A mere 1,081 listings were for sale over 2007, which was the second lowest amount in decades the MLS ever posted (2006 had 1,065).

2009 Real Estate Market Statistics – Activity Hits Rock Bottom

In two very short years the market collapsed to 467 transactions and $267 million in dollar volume. Sellers were drastically looking to unload their properties as listings jumped to 2,122. Only 22 percent (absorption rate) of MLS listings were purchased.

The new ski area operator was weathering the storm. Starwood remained as the operator of the Sheraton hotel and golf course and the Steamboat 700 developers were hosting open houses to share their vision of their project and obtain public input and buy-in, only to lose their annexation attempts by public vote with 61 percent opposing the project in 2010.

Deliveries of several of the new condo and land projects that were under construction a few years earlier were under way. Developers were looking forward to closing on purchase agreements they secured over the past several years, only to discover the economic downturn changed the ability for, or minds of many of, those buyers to close, leaving them with a good amount of unsold inventory. This was a death sentence for some and as time would later tell, only the financially strong would survive.

Routt County foreclosures jumped from 55 in 2008 to 195 in 2009.

2012/2013 Real Estate Market Statistics – Property Values Find Bottom

Market demand (transactions) increased slowly after 2009, but listings still outpaced purchases through 2011. The market needed three more years of steady improvement before prices began any positive movement. Average prices for all properties in the Steamboat Springs MLS for 2011 were $475,574, dropped to $439,885 in 2012, and were essentially identical in 2013 at $440,360. Average prices jumped an amazing 19 percent in 2014 to $523,065 and supported by 1,025 transactions, which was the first time since 2007 the thousand threshold was achieved.

By this time only a few of the real estate ventures that started in 2007 had survived. The Sheraton Hotel and Steamboat 700, as well as Bear and Emerald Lodges, Howelsen and Alpen Glow condominiums and the Alpine Mountain Ranch land project remained with their original owners. Others required properties being relinquished to their creditors, structural reorganization, and/or being sold to new ownership.

After hitting a record 306 foreclosures in 2011, 2012 dropped to 217, then to 135 in 2013…hinting the market finally found bottom.

2016 Real Estate Market Statistics – Momentum Continues

The 1,193 transactions posted in 2016 was the fifth best ever recorded by the MLS, and produced $618 million, which was the third best on record. Listings dropped for the sixth straight year to 1,447. The average price in 2016 was $534,000. The big story in 2016 was the long-dormant Stagecoach Ski Area going under contract (as of press time has not closed), which accelerated sales around that community. This added activity, along with a lower price point in the Stagecoach area, is why the average price was not as high as it could have been.

Due to property value increases within Steamboat Springs city limits, buyers began heading up or down valley into neighboring communities. Limited residential supply increased land activity 29 percent with 205 purchases. With 13 properties selling for $3.5million or above (one more than the prior two years combined), 2016 could be considered the year Steamboat’s luxury market came out of its slumber.

2016 ended with a mere 31 foreclosures, the lowest number since the turn of the century.

Looking Ahead: 2017 and Beyond

As if news of Stagecoach possibly selling in 2016 wasn’t big enough news, in the first quarter of 2017 Aspen Skiing Company / KSL Capital Partners, LLC announced they were purchasing the Steamboat Ski Area with an anticipated third quarter closing. Events like this spark interest and increase activity to resort areas. The Steamboat Springs real estate market should not be any different, and I expect the good market to get even better. The buyer’s market that existed since 2009 is gone.

Interest rates are creeping up and are projected to continue to do so, but the market segment that will be most affected by a rate increase is the first time homebuyer, where every dollar counts. However, the true Achilles Heel for the Steamboat real estate market is going to be new supply meeting demand. The Colorado Department of Local Affairs estimates Routt County’s population will grow from 25,000 to 35,000 by 2030.

Some undeveloped land remains around the ski area base, but that location will meet more second than primary home demands. The Steamboat 700 property west of town provides the best option for a true master planned community, but before a shovel is turned, city council and residents will need to change their mindset about annexation that they had in 2008.

As history documents, every market goes through cycles. Near term it is safe to say the current upward trend the market has experienced will continue

ABOUT THE AUTHOR: Doug Labor’s real estate career began in 1983, which has included executive level positions with some of the largest ski and golf resorts in North America, with disciplines in real estate brokerage, sales, marketing, construction, resort master planning, development and general management. While possessing such a well-rounded and in-depth background in a number of real estate disciplines, Doug’s specialty is simply helping clients, no matter if they are in the luxury or introductory market. What he enjoys most in his real estate practice is providing proven, logical and valuable guidance in helping clients accomplish their goals. Doug is the General Manager for Sotheby’s downtown office.